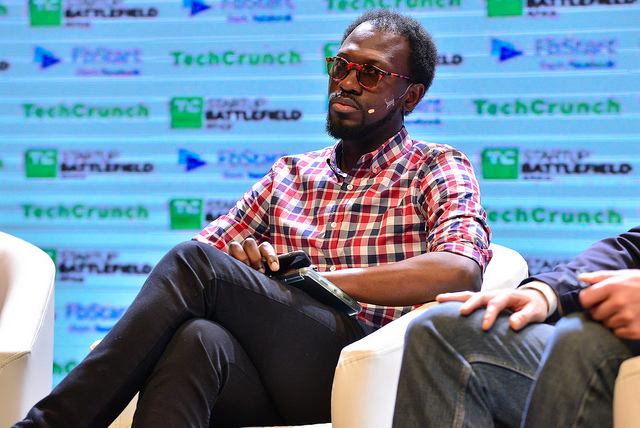

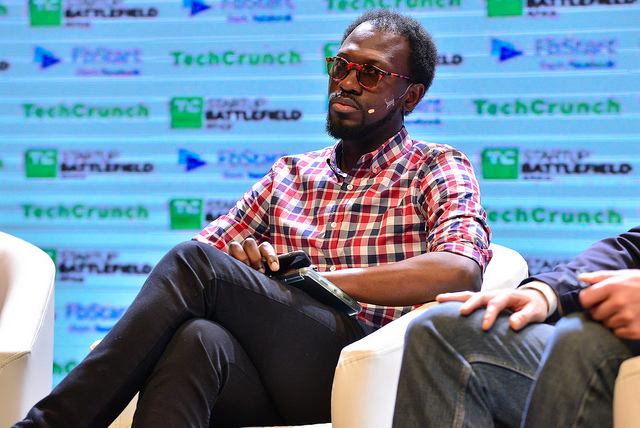

Payments (especially cross-border payments), have been a real issue for consumers and businesses in Africa. Where it was quite hard to receive payment from customers outside the continent. This partnership has happened to ease this process. What this means for businesses in Africa, is that they can sell their products to consumers in virtually every country where PayPal is enabled. And receive payments from their customers seamlessly. And according to PayPal, they are available in more than 200 countries and regions. READ MORE: Paystack Commerce vs Flutterwave Store vs Quickteller Storefront: Which is Best for Your Business? The Founder and Chief Executive Officer of Flutterwave, Olugbenga ‘GB’ Agboola, said this about the partnership: He went on to emphasize PayPal’s global reach and the opening up of their merchants to new markets. The progress of Flutterwave on the continent has been very impressive. Since its inception, the company has processed over 140 million transactions worth over USD $9 billion worldwide. This has seen it raise various funding rounds (we detail its journey here) and get to the “unicorn” status. PayPal’s partnership with Flutterwave is bound to boost these numbers further and introduce a new wave of African merchants selling to new markets. According to them, the collaboration “further underscores its commitment to ensuring merchants have vast opportunities to deliver services and conveniently transact through its platform.” To accept payments via PayPal, you must be a registered business on Flutterwave. Then you should enable PayPal as a payments option from your dashboard. Your customers will then see the “Pay with PayPal” option during checkout.